Tax season can be a stressful period, and a key element in successfully navigating this time is having a grasp of the various forms you encounter. One such form you might come across is the 1099 form. But what precisely is a 1099 form, and how does it influence your tax situation? In this extensive guide, we will provide a detailed overview of everything you should be aware of regarding 1099 tax forms, making your tax season less intimidating.

In this article, the team at Check Issuing aims to answer the following questions:

What is a 1099 form? When are 1099 forms issued, and how you can file one.

Understanding the 1099 Form

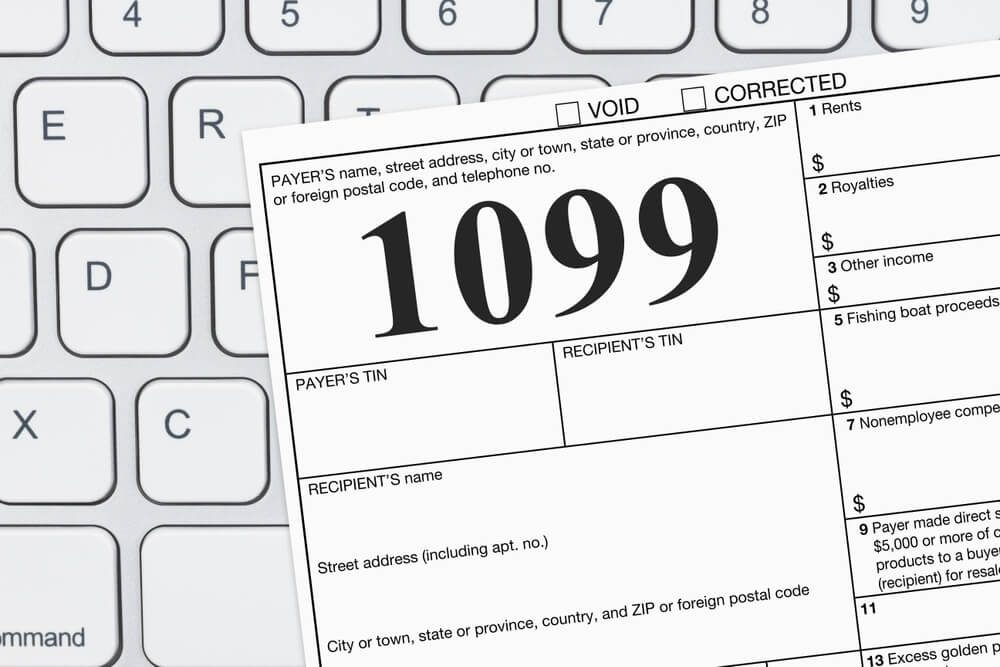

The 1099 form plays a pivotal role in reporting various types of non-employment income to the Internal Revenue Service (IRS). Unlike the W-2 form, which reports employment income and is typically provided by employers, the 1099 form is used to report other sources of income. These forms are categorized as “information returns” by the IRS and come in various variations, each intended to report specific types of income.

The Purpose of the 1099 Form

At its core, the 1099 form serves to document and report income earned from sources other than traditional employment. These sources encompass dividends, interest, rental income, payments to independent contractors, and more. Essentially, if you’ve received income not reported on a W-2, a 1099 form might be in your future.

Common Scenarios Requiring 1099 Forms: When Are 1099 Issued?

- 1099-NEC: Freelancers or independent contractors who earn $600 or more from entities other than their employers can expect a Form 1099-NEC.

- 1099-MISC: If you’ve earned $600 or more from rent or royalty payments, a Form 1099-MISC is likely headed your way.

- 1099-G: Receipt of a state or local tax refund during the previous year warrants a Form 1099-G.

- 1099-DIV: Individuals who receive dividends from stocks or other investments will be furnished with a Form 1099-DIV.

These are merely a few examples, as various types of 1099 forms exist to cater to diverse income sources.

Issuers of 1099 Forms

Entities such as businesses, government agencies, or individuals can be the issuers of 1099 forms. These forms are used to document financial transactions between these entities and another party. In most instances, businesses furnish 1099 forms to individuals or other businesses with whom they’ve engaged in financial dealings. For instance, businesses typically send 1099-NEC forms to independent contractors or freelancers.

Timing of 1099 Issuance

The deadlines for sending out 1099 forms differ based on the form type and whether you are the sender or the recipient. For instance:

- Most 1099 forms must be in the hands of the recipient by January 31st.

- If you are mailing a paper form to the IRS, it should be postmarked no later than February 28.

- Using tax software to e-file forms with the IRS provides a deadline of March 31.

It’s worth noting that Forms 1099-NEC must reach both the recipients and the IRS by January 31. This early deadline is designed to facilitate the IRS in detecting refund fraud more efficiently and provides taxpayers with ample time to prepare their tax returns.

Prominent Types of 1099 Forms

Numerous 1099 form types exist, each tailored to report specific types of income. Here are some of the most prevalent 1099 forms:

- 1099-NEC (Non-Employee Compensation): Employed for reporting non-employee compensation, such as income derived from freelancing or independent contracting.

- 1099-MISC (Miscellaneous Income): This form encompasses a broad spectrum of non-employee income, including rent, royalties, prizes, awards, and medical payments, among others.

- 1099-INT (Interest Income): Individuals who have earned more than $10 in interest income will receive a 1099-INT.

- 1099-DIV (Dividends and Distributions): Reporting dividends and certain distributions from investments is the purpose of this form.

- 1099-G (Certain Government Payments): Unemployment compensation and state or local income tax refunds necessitate the issuance of this form.

- 1099-B (Proceeds from Broker and Barter Exchange Transactions): This form is utilized to report sales of stocks, bonds, and other securities executed through brokers.

- 1099-R (Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc.): Distributions from retirement plans are reported using this form.

- 1099-S (Proceeds from Real Estate Transactions): Real estate transactions prompt the issuance of this form.

- 1099-K (Payment Card and Third Party Network Transactions): This form is employed for reporting credit card and third-party payment processing revenue received by online businesses.

These represent only a selection of the many 1099 form types designed to correspond to a variety of financial transactions.

What to Do Upon Receiving a 1099 Form

Upon receiving a 1099 form, it is vital to scrutinize it carefully to verify its accuracy. If you detect an error or inconsistency, reach out to the issuer and request a corrected form. Once the information has been confirmed, you will utilize it to accurately report your income on your tax return. These are the recommended steps:

- Maintain Records: Retain copies of all your 1099 forms for your records, as they supply vital information for your tax return.

- Report the Income: Depending on the nature of your income, you may need to report it in different sections of your tax return, such as Schedule C, Schedule E, or Schedule F. Ensure you report all your income accurately.

- Claim Deductions: If you are eligible for deductions related to the reported income, make certain to claim them on your tax return. For instance, if you have received a 1099-NEC for freelance income, you can deduct qualifying business expenses.

- Settle Tax Obligations: Should you owe taxes on the reported income, it is imperative to remit the correct amount to the IRS. Moreover, if you receive multiple 1099 forms throughout the year, you may also need to make estimated tax payments.

Obtaining a Duplicate 1099 Form

In the event you have not received the 1099 form that you were anticipating, or if you have misplaced the one you received, you can undertake the following measures:

- Contact the Issuer: Initiate communication with the individual or business responsible for issuing the form and request a duplicate.

- Inspect Your Online Accounts: Some entities offer electronic copies of 1099 forms through their websites. Explore your online accounts to check for the availability of digital copies.

- Reach Out to the IRS: If all else fails, you can seek assistance from the IRS. You may contact them at 1-800-829-1040 to receive guidance on acquiring a copy of the missing form.

Penalties for Inaccurate or Late Filing of 1099 Forms

It is imperative to submit your 1099 forms accurately and within the designated time frame. Failure to do so may result in penalties. Penalties vary based on the type of form and the lateness of the filing. Common penalties comprise:

- Filing within 30 days of the due date: $50 per form, with a maximum of $194,500.

- Filing after 30 days but before August 1: $110 per form, with a maximum of $556,500.

- Filing after August 1 or not filing at all: $270 per form, with a maximum of $1,113,000.

In the case of intentional disregard of the rules, the penalty can be $550 per form without an upper limit.

Conclusion

Comprehending 1099 tax forms is a fundamental aspect of managing your tax obligations. Whether you are a freelancer or investor or have diverse sources of income beyond traditional employment, these forms are your tools for accurately reporting income to the IRS. It’s important to keep in mind that tax laws and regulations may evolve, so it is advisable to consult with a tax professional or visit the IRS website for the most up-to-date information on 1099 forms and your tax responsibilities.

That said, if you want to learn more about filing the 1099 tax form or our services, feel free to reach out to us today.