If you’re a small business owner, there are a lot of things to think about during the year, including annual taxes. You might already be familiar with the process of small business tax preparation and execution, but it’s good to revise sometimes.

Filing federal income taxes for small businesses can be done in a few ways, but you should find the one that suits your business the best. Depending on how you run your business – as a sole proprietorship or you use a corporation or an LLC – you will file your federal income taxes accordingly. Without further ado, we’re here to help you understand the process of filing income taxes for small businesses.

How to Do Small Business Taxes

Since all small businesses have to calculate their profit and loss for their income taxes, being informed about the small business tax return and other relevant procedures and forms is paramount for doing a good job. You should be aware of what forms you should use in the process and how to gather all the necessary information for the forms as well.

It’s always good to be aware of certain steps you should take during the process and avoid unnecessary stress. Some of the things you should always pay attention to and have in mind include the following:

- Collecting All Your Records

The first step in the tax income process for any business involves gathering the necessary paperwork and collecting all your records. Before you start filling out your form, make sure to have all your business earnings and expenses records in front of you.

To avoid forgetting to include something, it’s a good idea to use a spreadsheet or another program to keep track of all your earnings and expenses during the year. Programs such as Quicken and QuickBooks are a good way to do that, so you can give them a try.

Another way to always keep track of your income taxes is to hire a professional service such as Checkissuing to help you. Our unique mission is to provide our clients with the necessary help with tax forms, rebate and refund processes, digital checks, accounts payable outsourcing and other relevant services. We will make sure your forms are correctly filled out and sent on time. Contact us today for more info.

- Finding the Right Tax Form for Your Small Business

If you know how to file business taxes, you probably know that finding the right tax form for your small business is of paramount importance. Determining the correct IRS form, reporting your business earnings, and paying your taxes is something you shouldn’t postpone or disregard. Depending on the type of your small business, there are different forms you should fill out.

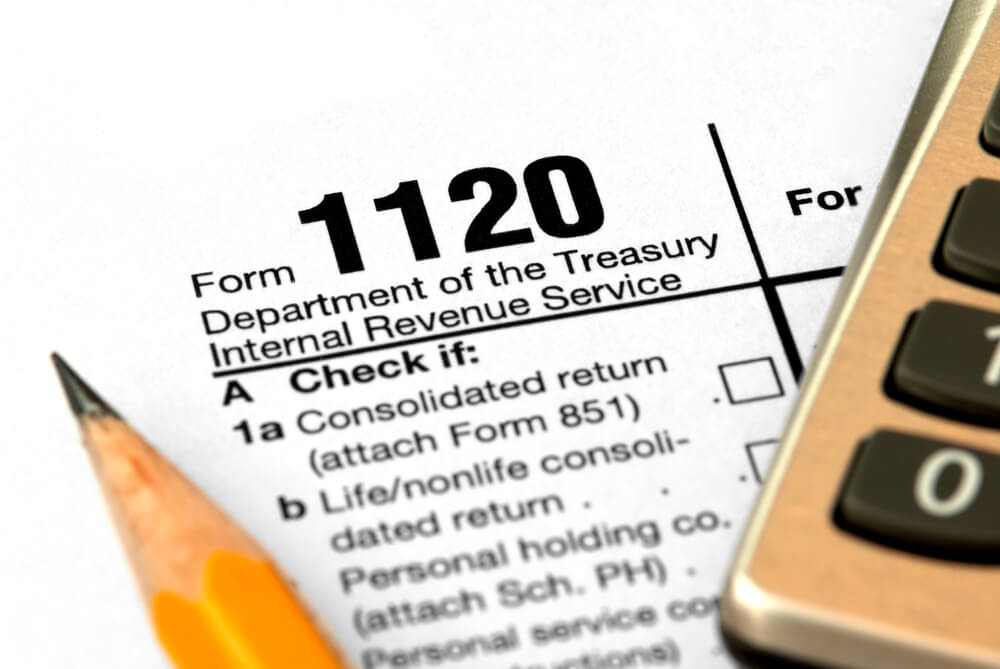

Usually, most small business owners manage a sole proprietorship and they need a Schedule C attachment to their personal income tax return to report all their business earnings and expenses. If your business is an LLC, or you are the only owner, you will be allowed to fill out a Schedule C attachment as well. However, if your LLC and corporation are treated as one entity, then you should always make sure to prepare and file a separate corporate tax return on Form 1120.

The good thing is that, if you opt to hire professionals, you won’t have to deal with this and think about what you need to do and when, because we can take care of everything for you.

- Filling out Your Form Properly

Once you’ve gathered all the necessary information and forms, it’s time to fill out your form correctly. Depending on what form you should report to the IRS, there are slight differences in filling them out properly:

- Filling out a Schedule C Form

Filling a Schedule C form is quite easy because it’s only two pages long. This is where you are supposed to list all your business expenses in a year. When you finish filling out the form, you should subtract your costs from your business incomes and you will get your net profit or loss. When you get this number, just transfer it to your personal income tax form as a part of all your personal income items.

- Filling out a Form 1120

If you’re required to fill out a Form 1120, you will need to invest some effort and include more details. You can calculate your taxable business income in the same way, however, the biggest downside of the Form 1120 is that it has to be filed as a separate form from your personal income tax return.

- Respecting the Deadlines

Knowing how to do business taxes includes being aware of all the deadlines you have to respect for filing your forms. The type of tax form you need for reporting your business earnings and costs will determine the deadline for filing it.

For a Schedule C Form, your deadline is the same as for the Form 1040, there are no separate filing deadlines. You should send these forms by April 15th.

If your business is treated as a C-Corp, you will have to send in your Form 1120 by the 15th day of the fourth month following the end of the year. This is usually done by April 15th for most taxpayers.

If your business is an S-Corp, your Form 1120s will have to be sent in by the 15th of the third month following the close of the tax year – usually by March 15th. This form cannot be sent to the IRS together with your personal tax return form, so make sure to know all your deadlines on time.

In case the due date falls on a weekend or holiday, the next business day is counted as the due date for that particular year.

- Ways of Filing Your Tax Forms

Finally, once everything is filled out and ready for filing, you can choose to file your forms by mail or electronically. The last page of the instructions of Form 1040 has the list of all the addresses you can use to file your tax forms to the IRS. Whatever option you opt for, make sure to file all the forms so that they arrive on time to the IRS.

Filing federal income taxes is no easy task, but absolutely necessary for successfully running your small business. Hopefully, our tips will help you speed up the process, but if you feel like this is too much for you, you can always hire someone to do all the work for you. Checkissuing is at your disposal for making an assessment of what forms you will need, making sure to fill them out properly, and filing them to the IRS timely and accordingly. Contact us today!